35+ 30 year mortgage payment calculator

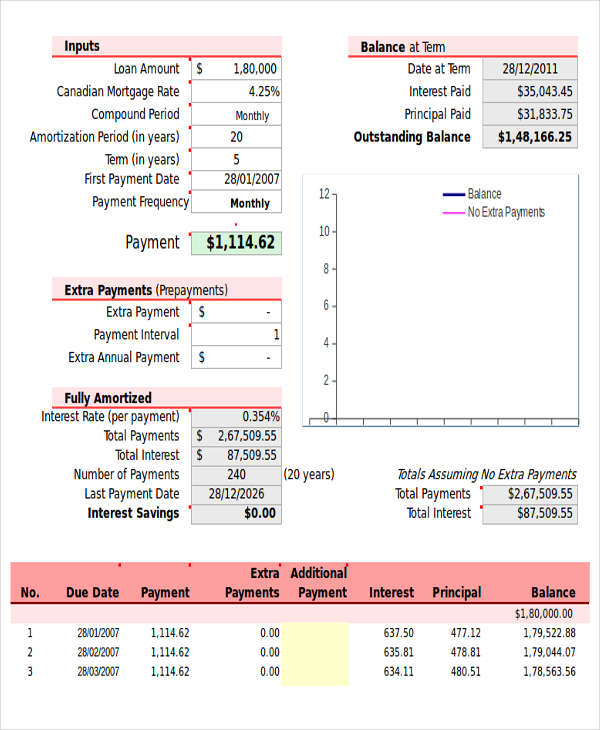

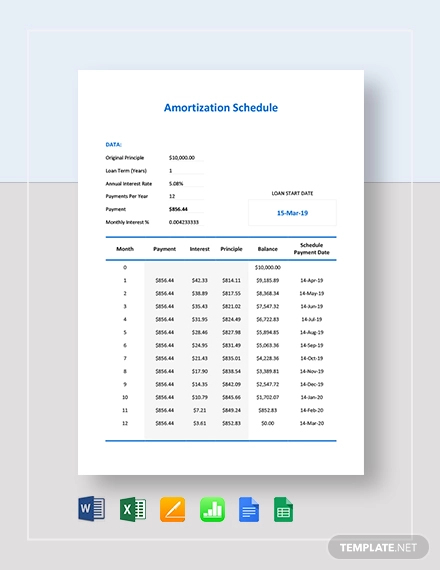

Historical 15-YR 30-YR Mortgage Rates. Need a sample amortization schedule for a 30-year fixed mortgage.

Pin By Ruby On My Stuff Messages Besties Timeline

The maximum amortization is 25 years for down payments under 20 and 35 years for higher down payments.

. The maximum amortization is 25 years for down payments under 20 and 35 years for higher down payments. Dont forget property taxes and utilities ideally keeping them at 35. Do not underestimate the one extra payment a year for your mortgage because it can save you thousands of dollars in interest payments and may pay off your mortgage a few years ahead of the regular monthly payment.

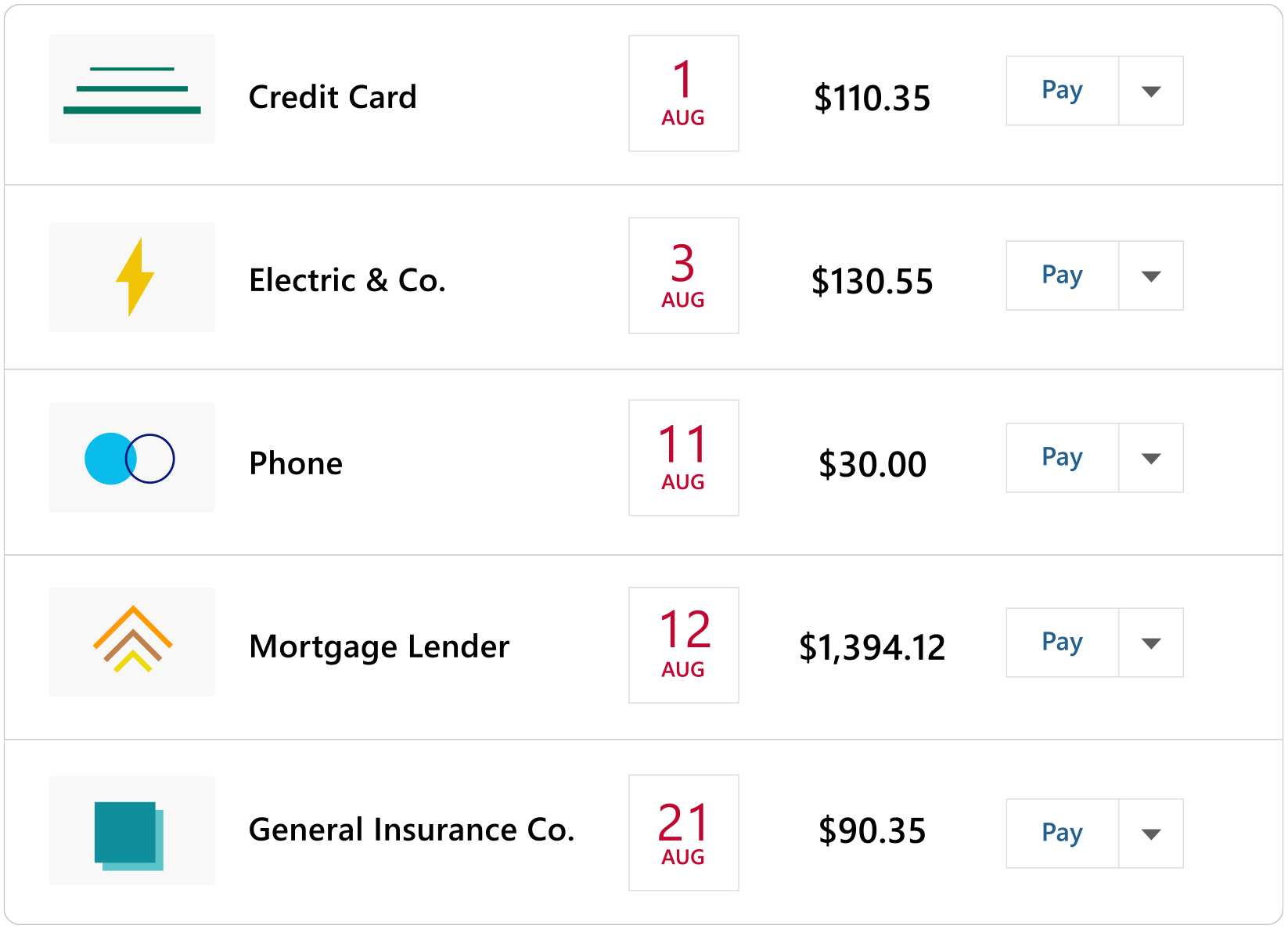

Use the Mortgage Payment Calculator to discover the estimated amount of your monthly. Deduction for medical expenses that exceed 75 of AGI. Due to the longer payment duration interest rates in a 30-year mortgage are often higher.

In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which. Resulting in an additional payment in a year. If you can afford it consider taking a 15-year mortgage over a 30-year term.

The minimum down payment in Canada is 5. 35 AM NEW Housing. The repayment period must be a minimum of 1 year and a maximum of 30 years.

You can use the following calculators to compare 20 year mortgages side-by-side against 10-year 15-year and 30-year options. Use our Ontario mortgage calculator to determine your monthly mortgage payment for your home purchase in Ontario. When you take out a mortgage you agree to pay the principal and interest over the life of the loan.

Deduction for mortgage interest paid. Our mortgage payment calculator shows you how much youll need to pay each month. Equally a 75 year-on-year increase in first-time buyers taking out 35-year mortgages during the stamp duty holiday in order to combat rising house prices.

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. The maximum amortization period for all mortgages is 35 years. The above calculations presume a 20 down payment on a 250000 home a closing cost of 3700 which is rolled into the loan.

Mortgage interest rates are always changing and there are a lot of factors that. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global.

Interest paid on the mortgages of up to two homes with it being limited to your first 1 million of debt. Deduction for charitable contributions. Home Price Down Payment.

Use our calculator above. Each of the above issues are explained in detail beneath our homeownership tax benefits calculator. As of August 18 2022 the best high-ratio 5-year fixed mortgage rate in Canada is 419.

Mortgage default insurance - also called CMHC insurance - must be purchased for down payments. Historical 30-YR Mortgage Rates. Mortgage Payment w Amortization.

Down payment The amount of money you pay up front to obtain a mortgage. I just switched my 30-year home mortgage to student loan Follow me for more financial advice. Calculate loan payment.

For example lets compare interest costs between a 30-year fixed mortgage and 15-year fixed mortgage with a lower. There are options to include extra payments or annual percentage increases of common mortgage-related expenses. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then click Calculate to update the page.

Lenders charge a higher interest rate precisely because payments are spread out for 30 years. Mortgage default insurance - also called CMHC insurance - must be purchased for down. Original monthly mortgage payment with insurance property tax HOA.

Evaluate your total housing payments eg. For this reason when they can afford it homeowners refinance their 30-year mortgage into a 15-year loan when index rates are lower. Effective Mortgage Payment After Income Tax Savings Amount.

Please select a payment frequency. As of August 18 2022 the average 5-year fixed mortgage rate available from the Big 5 Banks is 532. To estimate your break-even point more easily you can use the above calculator.

Use this simple online mortgage calculator to easily estimate your monthly mortgage payment interest rates and taxes. On a 30-year fixed-rate mortgage the payment is divided up by monthly payments where a borrower will pay the same amount each month for 30 years. The following table lists historical average annual mortgage rates for conforming 30-year mortgages.

30-Year Fixed-Rate Mortgage Loan Amount. 30-Year Fixed-Rate Mortgage Loan Amount. Nov 30 2041.

20-year mortgages tend to be priced at roughly 025 to 05 lower than 30-year mortgages. The current best high-ratio fixed mortgage rate in Quebec is 424. This shortens their payment duration and helps them save thousands on.

This calculator will also figure your total monthly mortgage payment which will include your property tax property insurance and PMI payments. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000. Over 60000 first-time buyers did so.

You can even compare scenarios for different down payments amounts amortization periods and variable and fixed mortgage rates. It also computes your total mortgage payment inclusive of property tax property insurance and PMI payments monthly PITI payments. 15 2017 have this lowered to the first 750000 of the mortgage.

Almost any data field on this form may be calculated. Homes purchased after Dec. In the beginning most of your monthly payment goes towards paying.

Refer to this example to help you understand the basics of how different points affects the overall cost of a mortgage. Use our BC mortgage calculator to determine your monthly mortgage payment for your home purchase in BC. Loan to value is the ratio of the amount of the mortgage lien divided by the appraisal value of a property.

How much income you need depends on your down payment loan terms taxes and insurance. If you put 20 down on a 200000 home that 40000 payment would mean the home still has 160000 of debt against it giving it a LTV of 80. 65897 66.

For down payments of less than 20 home buyers are required to purchase mortgage default insurance commonly referred to as CMHC insurance. With a 20 down payment on a 30-year mortgage and a 4 interest rate you need a household income of 70000 yearly or more before tax. You can use the following calculators to compare 15 year mortgages side-by-side against 10-year 20-year and 30-year options.

This rate is available in Ontario Alberta and British Columbia. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Brets mortgageloan amortization schedule calculator.

Though your amortization may be 25 years your term will be much. LTV is the reciprocal.

Quicken Premier Software For Windows Download Quicken Today

Additional Mortgage Payment Savings Infographic Househunt Real Estate Blog Mortgage Payment Savings Infographic Mortgage Info

Celebrity Homes An Inside Look

Pin On Money Making Ideas

35 Bike Storage Ideas For Small Apartments Bike Storage Solutions Indoor Bike Storage Bike Storage Apartment

![]()

35 Real Estate Logos Ai Eps Real Estate Logo Design Real Estate Logo Architecture Logo

35 Best Wordpress Calculator Plugins To Pick For Your Website

Set Of Greeting Cards Happy Home Anniversary Real Estate Etsy House Anniversary Cards Greeting Cards Cards

Lunch And Learn Invite Template Beautiful Lunch And Learn Invitation Invitation Template Wedding Invitations Printable Templates Simple Invitation

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Pin By Ruby On My Stuff Messages Besties Timeline

35 Everyday Things You Didn T Know Had A Brilliant Purpose Life Just Got Easier Ice Cream Scooper Ice Cream Scoop Sizes Scoop

Do You Want To Work From Anywhere You Can In 3 Easy Steps Job Employment Job Seeker

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Explore Our Sample Of Real Estate Investment Analysis Template Investment Analysis Spreadsheet Template Real Estate Investing

29 Amortization Schedule Templates Free Premium Templates

29 Amortization Schedule Templates Free Premium Templates